College can be a financial burden, but there are ways to manage the cost! Explore scholarships, grants, and savings plans first to minimize student loans. Before applying for any loans, have a candid discussion with your child about who will be responsible for repayment after graduation. Remember, there are loan-free options too, like scholarships or grants. Planning and exploring all your options can make college financially achievable.

As the college years draw nearer, many parents and guardians ask themselves, "How do parents pay for college?" College is a considerable investment in your child's future, and many parents strive to help somehow.

Realistically, it's difficult or even feasible for some parents to cover college costs. In addition to helping their child pay for college, parents and guardians are paying mortgages or rent, utilities, and retirement savings.

As students and parents explore various college tuition funding sources, they may find that there is still a financial gap between the financial aid and scholarships offered and the cost of attending college. This may be a signal that it's time to consider applying for student loans.

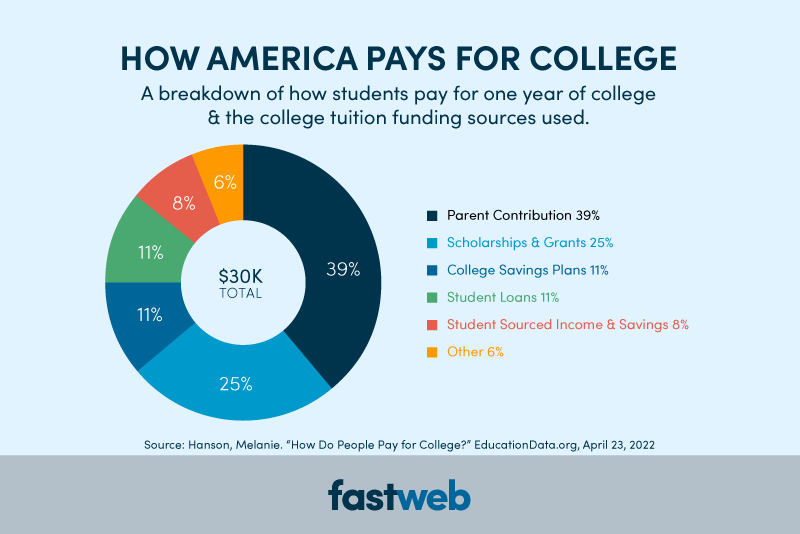

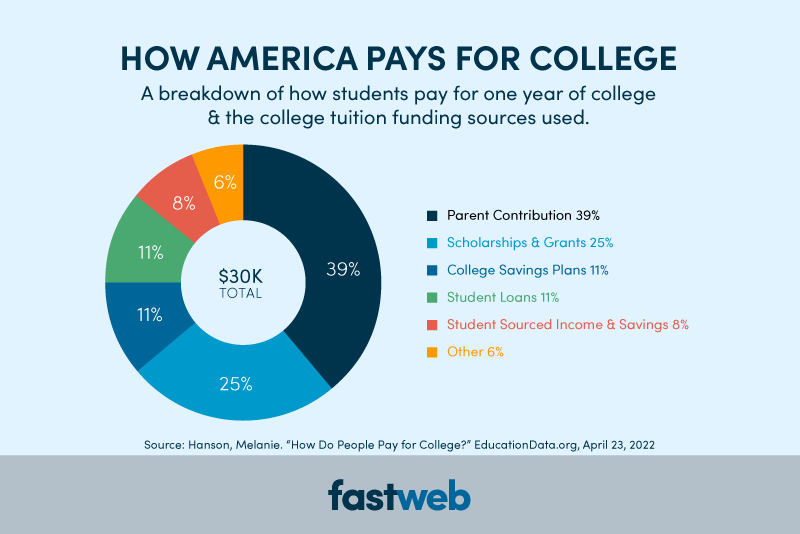

As you can see, families aren't paying for college with only student loans. It may not be the wisest investment if that's your first-choice option for "affording" a particular college. Student loans should be used as a last resort after all other funding options (scholarships, financial aid, college savings plans) have been exhausted.

Parent PLUS loans, however, do not have a six-month grace period. This is because the federal government has lent the money to the parents, who have had to prove they are employed and have good credit before borrowing. It is assumed that they can begin repaying the loans immediately. However, there are exceptions for those going through undue financial circumstances. The application process typically involves submitting a loan application, providing financial information, and agreeing to the terms and conditions of the loan.

As you can see, families aren't paying for college with only student loans. It may not be the wisest investment if that's your first-choice option for "affording" a particular college. Student loans should be used as a last resort after all other funding options (scholarships, financial aid, college savings plans) have been exhausted.

Parent PLUS loans, however, do not have a six-month grace period. This is because the federal government has lent the money to the parents, who have had to prove they are employed and have good credit before borrowing. It is assumed that they can begin repaying the loans immediately. However, there are exceptions for those going through undue financial circumstances. The application process typically involves submitting a loan application, providing financial information, and agreeing to the terms and conditions of the loan.

What Parents Need to Know Before Taking Out Student Loans

Firstly, student loans get a bad rap. Still, they're how America pays for college, and other college tuition funding sources.

How will the student loans be repaid?

After graduation, borrowers have a six—to nine-month grace period during which student loans do not have to be paid back. This period enables borrowers to find employment after college, settle into a routine, establish a budget, and then begin paying down student loan debt.Who will be responsible for repaying student loans?

It is assumed that parents will repay the loans for private parent loans for college and federally funded parent loans. However, children can work out with their parents, who will make those payments. In some cases, students and parents agree they will borrow in the parents' names. However, after graduation, children would then pay their parents for the student loan payments each month. It's up to each family to figure out what works for them before applying for student loans to pay for college.Parent's Guide to Student Loans

Like students, parents have options for borrowing money to pay for college. The most significant choice is securing private parent loans or federal Parent PLUS loans to help their child pay for school. Private lenders offer private parent loans and typically require a credit check, while federal Parent PLUS loans are offered by the government and require a current student FAFSA.Private Parent Loans for College

Many private lenders provide student loans to students and private parent loans for college. Fastweb can help you find private student-loan lenders. You can also ask your college about its preferred lender list. This list includes lenders the college works with or has worked with. These lenders already have an established relationship with the school or university.Parent PLUS Loans

It is recommended that you always borrow federal loans first, and that includes Parent PLUS Loans. These loans have historically lower interest rates than private student lenders. However, you should shop around to see if and who is offering better student loan interest rates. Unless you request a deferment on a Parent PLUS Loan, you must begin making payments once the loan is fully disbursed. You must have a FAFSA (Free Application for Federal Student Aid) on file before applying. The FAFSA is a crucial step in the financial aid process, as it determines your eligibility for federal student aid, including loans. The maximum amount you can borrow is the cost of attendance at your child's college, less any aid they receive. Parent PLUS Loans are eligible for the Public Service Loan Forgiveness Program (PSLF), if they're consolidated and being repaid with an Income-Contingent Repayment (ICR) plan, according to the Office of Federal Student Aid.Other Considerations for Parent Loans for College

Applying for private parent loans for college is not a decision that should be entered into lightly. Parents, guardians, and their children should havefinancial aid conversations before the college search begins to discuss who is paying for college and what type of college they can realistically afford. Student loans should also be used as a last resort. Exhaust these options before submitting a loan application:- Scholarship and Grants

- Financial Aid

- College Savings Plans

- Part-Time Jobs and Paid Internships

- Education Tax Benefits