Though federal student loans, such as the Federal Stafford Loan, help many students to attend college, families often find that even the maximum loan amounts are not enough to pay for their education.

For instance, the average cost of college the 2024-25 academic year is $38,270— yet the most money dependent, first-year college students can borrow under the subsidized Federal Stafford Loan program is just $5,500!

Private student loans are considered the fastest growing component of funds used to finance college. But just what are "private loans?"

In the education world, colleges often refer to loans made directly by banks and other lending organizations as "private" or "alternative" loans to distinguish them from federal loans. Private loans can be used alone or in conjunction with federal loans.

Technically, they are consumer loans that can be used for educational purposes. As with other consumer loans, borrowers must demonstrate that they meet credit guidelines.

For students who often have limited or no credit history, a creditworthy cosigner may be needed. What sets education consumer loans apart from other consumer loans is that collateral is not required to secure the debt. In many cases, repayment of the loan can be postponed while the student is in college.

The primary difference between federal loans and private loans is that the government guarantees federal loans against default. If a borrower defaults on repaying a federal loan, the government repays a portion of it. Many lenders provide the funds for both federal and private education loans.

Because there is less risk to a lender with a federal education loan, interest rates are generally lower for those loans than for private loans, for which a lender assumes all risk that the loan will be repaid.

Private student loans are considered the fastest growing component of funds used to finance college. But just what are "private loans?"

In the education world, colleges often refer to loans made directly by banks and other lending organizations as "private" or "alternative" loans to distinguish them from federal loans. Private loans can be used alone or in conjunction with federal loans.

Technically, they are consumer loans that can be used for educational purposes. As with other consumer loans, borrowers must demonstrate that they meet credit guidelines.

For students who often have limited or no credit history, a creditworthy cosigner may be needed. What sets education consumer loans apart from other consumer loans is that collateral is not required to secure the debt. In many cases, repayment of the loan can be postponed while the student is in college.

The primary difference between federal loans and private loans is that the government guarantees federal loans against default. If a borrower defaults on repaying a federal loan, the government repays a portion of it. Many lenders provide the funds for both federal and private education loans.

Because there is less risk to a lender with a federal education loan, interest rates are generally lower for those loans than for private loans, for which a lender assumes all risk that the loan will be repaid.

Financial aid forms required

Loan limits determined by grade level

Schools must authorize the loan amount

Funds are sent to the school

Satisfactory Academic Progress required to receive additional loans

Standard 10-year repayment term

Income-Driven Repayment plans

Restrictions on how loans may be used

Financial aid forms not required by private student loan lender

Higher loan limits

Signer and co-signer must have good credit

Faster application process

Funds may be sent to borrower

Longer repayment loan terms

Variable loan rates

Repayment options

Fewer restrictions on how the loan may be used (as for a computer for college or transportation)

Borrow federal student loans first.

Though there is a limit to the dollar amount students can borrow per year from the federal government, it still makes sense to borrow federal loans first. Of the student loan options, these are the cheapest. They offer the lowest student loan interest rates and fixed interest rates.

Some students may also qualify for subsidized student loans. These are for students who demonstrate financial need. During a student's college years, the federal government will pay the interest on the student loan, saving the student money on their student loan debt.

Never borrow more than the starting annual salary.

Students should never borrow more money than they can afford to repay. A good rule of thumb is to never borrow more than the expected annual salary upon graduation – or more than the parents make annually.

Many students are uncertain about their post-graduation plans. What they can do is look at the average starting salary for college graduates to determine their ceiling for student borrowing.

Students can also search for annual expected salaries by field of study. Perhaps they know that they will be majoring in English or engineering. Examining the salaries of recent graduates in both fields will enable students to make informed decisions about student loans.

Exhaust all options when paying for college.

To limit the amount of student loan debt taken on to pay for college, students can utilize other options. These include:

Work Study jobs on campus Students must complete their FAFSA via the Department of Education to see if they qualify for the federal work-study program.

Part-time jobs off campus

Scholarships

Tax Credits

Work study and part-time jobs can be found once a student arrives on campus. Even if a student doesn't qualify for a work-study job through financial aid, there may still be open positions on campus that are available to all students.

Work-study jobs allow students to get paid while maintaining a flexible working schedule.

Part-time jobs are available off campus and can provide more than just a paycheck. Many part-time jobs come with the added benefit of employer tuition assistance. These provide a great alternative to paying for college.

When it comes to scholarships, many students stop searching after their senior year of high school.

Many students don't realize there are thousands and thousands of scholarships for college students. By continuing to search for scholarships throughout college, students can discover additional options to help cover their tuition costs.

Tax credits are another option that students and parents can utilize to pay for school. During tax season, individuals and families can qualify for tax credits by being enrolled in college or other educational programs. These tax credits can be used to pay for student expenses.

When it comes to paying for college, students must be creative to minimize the amount of student loan debt they incur after graduation. It's essential to note that student loans are not inherently bad—they can be beneficial. Students need to ensure that they make wise borrowing choices and avoid accumulating student loan debt that is difficult to repay.

To get started on the student loan journey, check out Fastweb's Guide to Student Loans and College Cost Calculator.

How can families close the financial aid gap?

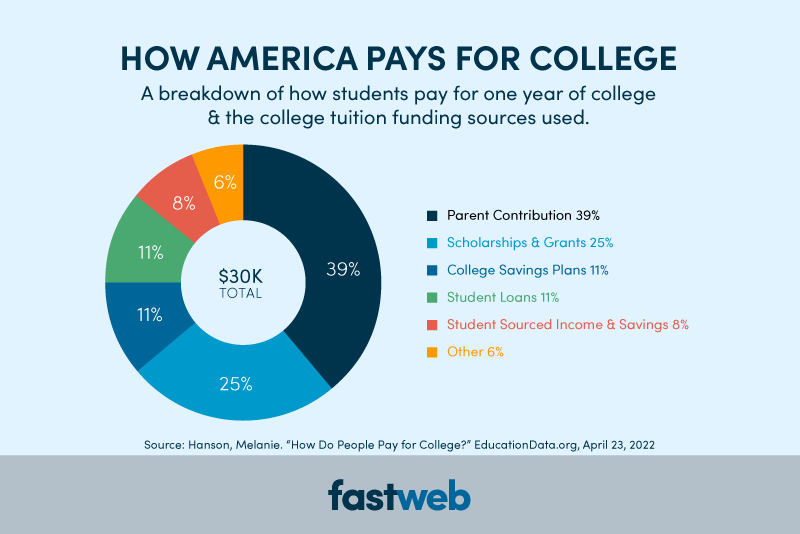

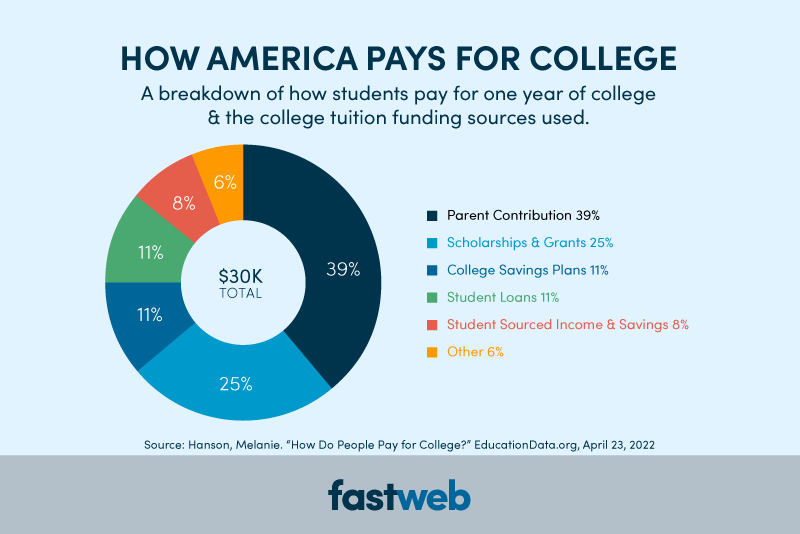

According to Educationdata.org , student loans (tied with college savings plans) are the third way students use to pay for college.