Taking on

any debt isn't ideal. However, student loans may be the one thing that will make your collegiate dreams possible. Therefore, it is essential to understand student loans fully now to decide which solutions are best for your situation.

What You Should Know about Student Loans

What is a student loan, and how do you get student loans? Let's answer these common questions below:

Student loans can be private or federal. Students use student loans to help pay for college.

The idea is that student loans are available to U.S. students to

fill the gap when paying for college. In other words, student loans should be taken after college tuition and expenses are covered first by grants (like the Federal Pell Grant), scholarships, income from a part-time job, Federal Work-Study programs, and 529 college savings plans.

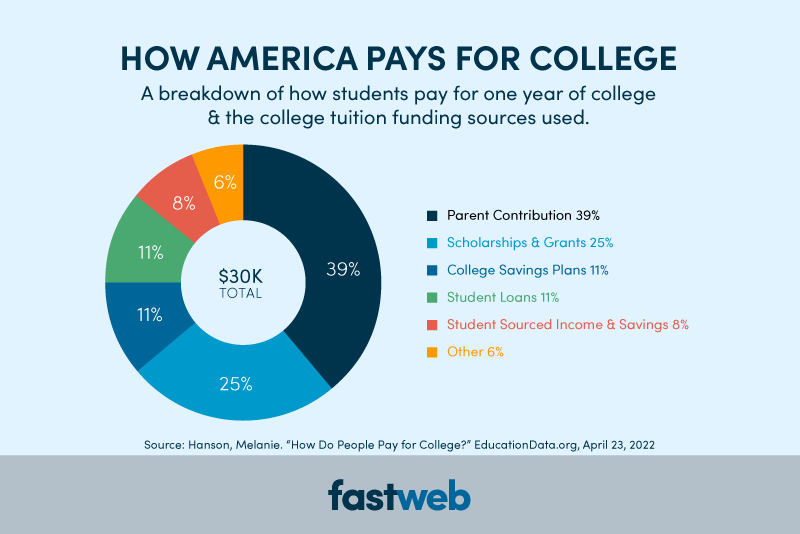

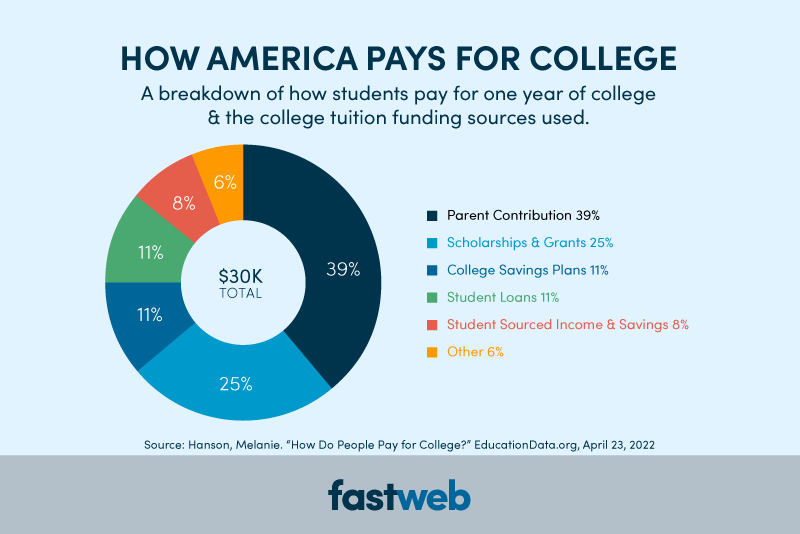

Student loans are borrowed money from the federal government or a private lender used to cover tuition payments while a student is enrolled. After graduation, the borrower must repay the borrowed money with interest. According to

Educationdata.org, after parent contributions and scholarships, student loans are the third most common way students pay for college.

Federal student loans have set interest rates, and these loans provide the lowest interest rates of any student loan. The U.S. Department of Education establishes the federal student loan interest rates. Students must complete and submit their Free Application for Federal Student Aid (FAFSA) to see if they qualify for a federal student loan. You can not get a federal loan without completing a FAFSA.

You will be expected to repay each student loan, and, in most cases, the loan interest will be capitalized. Over time, unpaid interest will accumulate, increasing the amount you owe. Therefore, you should select the loan option with the most favorable interest rates.

Do your research when looking for private student loan lenders! Below are seven things you should know about student loans:

Student loans are part of the financial aid package.

Most people correlate

financial aid with grants and scholarships – or free help – but student loans are also part of the package. They technically help pay for school, even though the funds must be repaid after graduation.

When you receive your financial aid package from each school, assume that only some of what is listed are grants or scholarships. Review each item carefully and contact your school's financial aid office if you have any questions.

There are two types of federal student loans.

Federal loans fall into two categories: subsidized and unsubsidized. To be eligible for any of these loan options, students and their families must submit a

FAFSA.

Subsidized Student Loans

Subsidized student loans are reserved for students with financial aid, and the federal government pays the interest while you're in school.

Unsubsidized Student Loans

Unsubsidized student loans are available to all students, regardless of financial need. However, students are responsible for paying all interest on the loans.

If federal student loans don't cover the cost, investigate private loans.

Though you may be awarded federal student loans in your financial aid package, they still might not cover the total cost of attendance. To find a private student loan, contact your school's financial aid office and ask about their

preferred lender list.

The schools put together this list. It offers a comprehensive look at who they work with, which might be helpful as you navigate the private loan arena.

Loan payments aren't due immediately after graduation.

Fortunately for borrowers, graduation does not bring an onslaught of student loan bills. Instead, you'll receive a six-month grace period during which no payments are required. This allows borrowers to find employment before taking on monthly loan payments.

There is such a thing as student loan forgiveness.

Student loans can be forgiven – but you must meet quite a few requirements.

Public Service Loan Forgiveness requires that you have a job serving in the public sector with government organizations, not-for-profits, and other types of qualifying public services like law enforcement, teaching, and military service.

Student loans can't be dissolved through bankruptcy.

While most debts can be terminated through

bankruptcy, student loans cannot. They are with you for life until you pay them off.

If you stop paying your student loans, the federal government can take your wages from work to pay the debt. It's best to make the payments on time and consecutively.

Don't borrow more than you can realistically handle.

Here's a good rule: don't borrow more than your starting annual salary. Research potential careers and salaries at

CareerBuilder + Monster.

You can use your findings to establish a borrowing cap. Borrowing more than you expect to earn will result in paying off more debt for many years.

Essentially, you can only take on what you can handle.

How do Student Loans Work?

Before you apply for a student loan, you should be sure to

apply for the Free Application for Federal Student Aid (FAFSA). The FAFSA is required to qualify for any need-based financial aid. College students must renew their FAFSA form yearly as well.

After

completing the FAFSA, you may earn grants and work-study to help you fund your college education. The money you still owe must be covered to enroll in and attend the college you are attending.

Some students and their families still require additional funding to cover their tuition costs. If this is the case, the next recommended step is to apply for federal student loans, such as unsubsidized ones.

To apply for a

private student loan, you need to apply directly with the student loan lender you choose. You want to

avoid vast amounts of student loan debt.

Advantages of Student Loans, if used responsibly.

Student loans should not be taken lightly. At the same time, student loans should not be viewed as negatively as they often are, because they're accommodating.

They can help students pay for school without the upfront cost.

These loans help to

bridge the gap between what college costs and what a student can pay.

Gives students a bit of financial flexibility for any unforeseen costs of higher education.

Other costs often surprise students and their families, especially incoming first-year college students. Some student loans can be used to cover the costs of textbooks and other educational expenses, such as computers.

Students get into trouble when they overborrow for college. Getting to know them sooner rather than later can help you plan better for

borrowing and repaying. You will be armed with the knowledge of what making payments after college will look like, rather than making harmful financial decisions without any idea of their impact.

Most 17- and 18-year-old students are not experts on student loans. Even

parents have difficulty finding suitable options for their students and articulating the commitment that comes with making monthly loan payments after graduation.

Fortunately, Fastweb offers a range of student loan assistance. Our

Student Loan Channel explains how education loans work, the type of loans available, and how borrowers can successfully repay them after graduation. We can also suggest private student loan options to help you finance your college education.

You don't have to be in the dark regarding federal and private student loan options. Educate yourself to make the best decision possible.

Get started on Fastweb.

Federal student loans have set interest rates, and these loans provide the lowest interest rates of any student loan. The U.S. Department of Education establishes the federal student loan interest rates. Students must complete and submit their Free Application for Federal Student Aid (FAFSA) to see if they qualify for a federal student loan. You can not get a federal loan without completing a FAFSA.

You will be expected to repay each student loan, and, in most cases, the loan interest will be capitalized. Over time, unpaid interest will accumulate, increasing the amount you owe. Therefore, you should select the loan option with the most favorable interest rates.

Do your research when looking for private student loan lenders! Below are seven things you should know about student loans:

Federal student loans have set interest rates, and these loans provide the lowest interest rates of any student loan. The U.S. Department of Education establishes the federal student loan interest rates. Students must complete and submit their Free Application for Federal Student Aid (FAFSA) to see if they qualify for a federal student loan. You can not get a federal loan without completing a FAFSA.

You will be expected to repay each student loan, and, in most cases, the loan interest will be capitalized. Over time, unpaid interest will accumulate, increasing the amount you owe. Therefore, you should select the loan option with the most favorable interest rates.

Do your research when looking for private student loan lenders! Below are seven things you should know about student loans: