US Department of Education Guidance

The US Department of Education has published guidance that is consistent with this interpretation of the statute in the 2009-10 and 2010-11 Application and Verification Guides. According to the US Department of Education, distributions from a 529 plan owned by someone other than the student or parent are reported as untaxed income on the subsequent year's FAFSA. The following is an excerpt from page AVG-18 of the 2010-11 Application and Verification Guide (emphasis added):

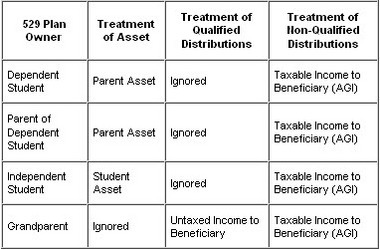

Qualified education benefits Qualified tuition programs (QTPs, also known as section 529 plans because they are covered in section 529 of the IRS tax code) and Coverdell education savings accounts are grouped together in the law as qualified education benefits and have the same treatment: they are an asset of the owner (not the beneficiary because the owner can change the beneficiary at any time), except when the owner is a dependent student, in which case they are an asset of the parent. When the owner is some other person (including a non-custodial parent), distributions from these plans to the student count as untaxed income, as "money received."

...

As long as distributions from QTPs and ESAs do not exceed the qualified education expenses for which they are intended, they are tax-free, so they will not appear in the next year's AGI. They should not be treated as untaxed income (except in the cases mentioned above) or as estimated financial assistance. For more information on these benefits, see the IRS's Publication 970, Tax Benefits for Education.

Workarounds

A 529 plan owned by the grandparent or other third party can hurt the student's eligibility for need-based financial aid. There are a few workarounds to address the treatment of such a 529 plan. 1. Wait until the senior year in college to take a distribution from the 529 plan. Since there will be no subsequent year's FAFSA to be affected (assuming the student does not plan on enrolling in graduate school), it will not affect eligibility for need-based aid. Technically, the distribution can happen as early as the spring of the junior year in college, since that will occur after the calendar year upon which the senior year's FAFSA is based. 2. Change the account owner to the student or the student's parent. However, some state plans do not permit a change in ownership, so it may be necessary to move the money to a different state's plan before changing the account owner. 3. Wait until after the student has graduated to take a non-qualified distribution (say, to pay down student loan debt). The income tax and tax penalty on the earnings portion of a non-qualified distribution are not as severe as the loss of need-based aid eligibility from treating the distribution as untaxed income to the student.

PROFILE Form Counts Grandparent-Owned 529 Plans as Assets

The CSS/Financial Aid PROFILE Form has a different treatment of 529 plans. All 529 plans that name the student as a beneficiary are reported as assets on the PROFILE. (The PROFILE also considers assets in the name of siblings who are under age 19 and not yet enrolled in college.) So a grandparent-owned 529 plan will be reported as an asset on the PROFILE.